Read Time: 2 min

The European Central Bank trimmed its key policy rate to 2percent on Thursday—its eighth cut since June2024—as euro‑area inflation eased to 1.9percent in May, dipping below the ECB's 2percent goal for the first time since early autumn.

Contrast with the Fed

The move intensifies the contrast with the U.S. Federal Reserve, which has kept rates on hold while it gauges the economic fallout from President Donald Trump's trade disputes. Trump has berated Fed Chair Jerome Powell for "dragging his feet," seizing on Europe's aggressive easing to demand similar action at home.

Why the ECB feels comfortable

Analysts say the ECB is acting from a position of relative strength. Core prices have dropped back to pre‑war levels, the euro's recent firmness is damping imported inflation, and cheaper energy is filtering through household bills. HussainMehdi of HSBC Asset Management called the ECB's stance "enviable," noting tariffs may even help contain prices by cooling demand.

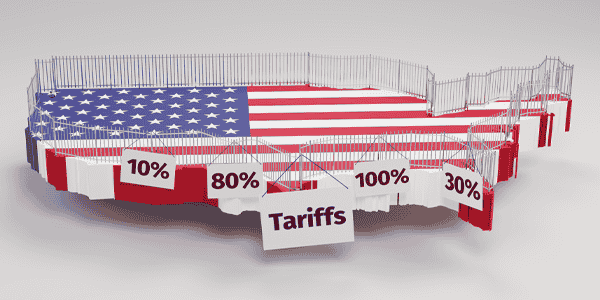

Lingering trade clouds

Still, ECB President ChristineLagarde warned that a fresh escalation in global trade tensions could sap euro‑area growth by denting exports and deterring investment. Negotiations with Washington continue, after Trump threatened a 50percent tariff on EU imports. Brussels' trade chief MarošŠefčovič said talks with U.S. counterpart Jamieson Greer were "advancing at pace," but economists argue uncertainty—not monetary policy—is the bigger brake on growth. If a deal materialises, momentum should rebound.