Read Time: 2 min

U.S. equities managed to close higher on Monday despite a new volley in the trade war. The Dow Jones Industrial Average added 35points, the S&P500 climbed 0.41percent, and the tech‑heavy Nasdaq Composite rose 0.67percent. Stocks opened lower but clawed back as the session progressed.

Winners and losers

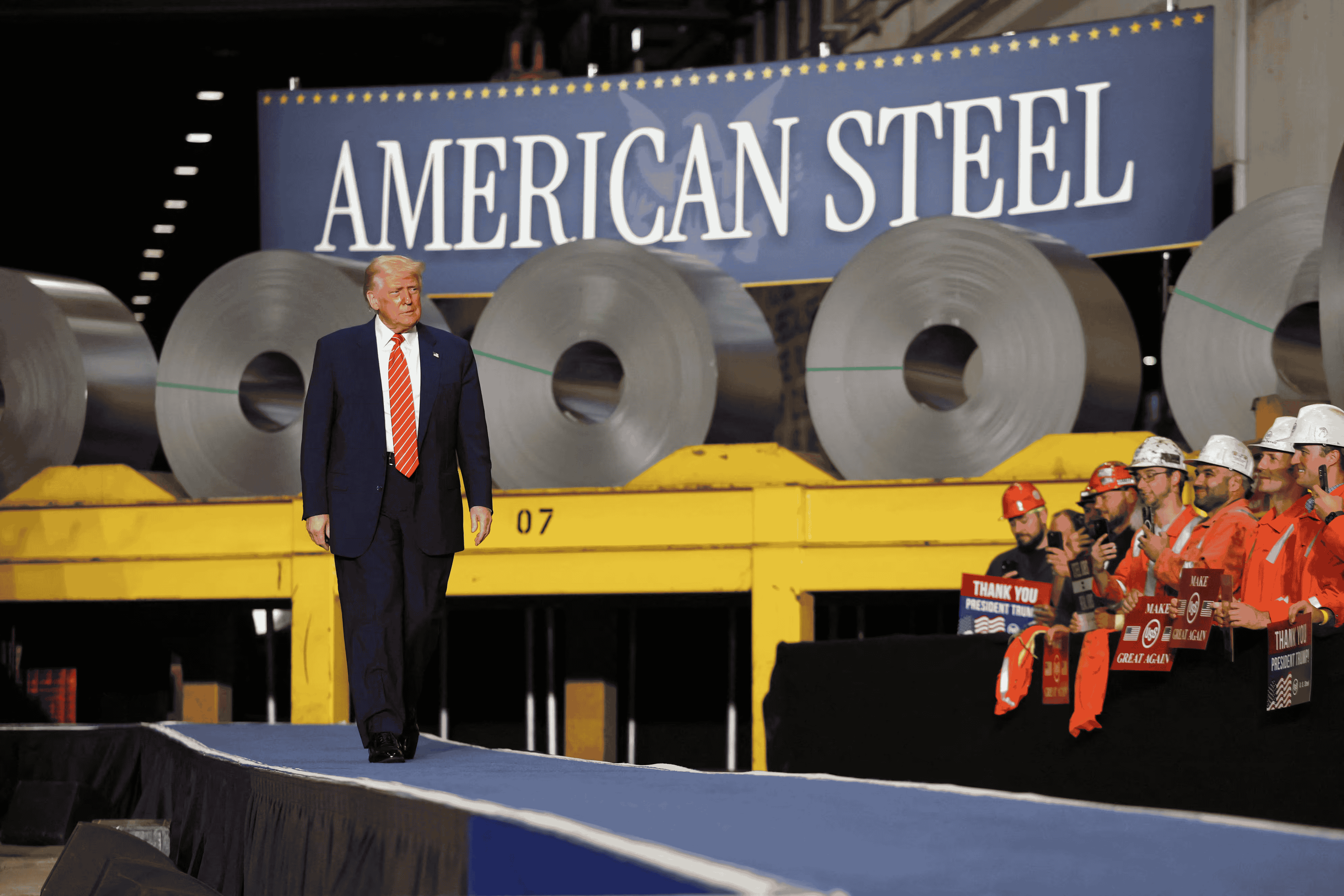

President Trump's decision to double steel tariffs to 50percent battered automakers—Ford fell 3.85percent, Stellantis 3.55percent, and GeneralMotors 3.87percent—but turbo‑charged domestic steelmakers. Cleveland‑Cliffs surged about 23percent, while Nucor and Steel Dynamics each gained roughly 10percent.

Safe‑haven moves

The dollar index slipped 0.65percent on renewed trade‑war anxiety. Gold jumped almost 3percent as investors sought shelter, and Treasury yields inched higher as bonds sold off.

Global backdrop

Asian markets were mixed: HongKong's HangSeng lost 0.6percent, Japan's Nikkei fell 1.3percent, while South Korea's KOSPI eked out a small gain. European bourses were broadly lower, and Brussels warned it stands ready to retaliate if Washington presses ahead without a deal.

Oil spike on fresh tensions

Separately, WestTexas Intermediate crude gained nearly 3percent after Ukrainian drones struck deep into Russian territory, offsetting news that OPEC+ will lift output for a third straight month.